On January 20, pump.fun officially announced a hackathon with a prize pool of $3 million, and simultaneously launched the ecosystem venture fund Pump Fund.

This is a very different hackathon. There are no judges, no theme, and there will be 12 winners, each taking away $250,000. Because of these special rules, before observing the projects, we need to first understand the logic behind this hackathon.

Called a Hackathon, Actually GFF 2.0

According to pump.fun's official statement, this hackathon abandons the traditional model of pleasing judges or investors to win funding, making the market the judge.

In short, it encourages everyone to launch tokens, and then it's up to their own abilities; whoever performs better in the market is more likely to win.

Apart from the requirement that the token must be deployed before the hackathon application deadline, the entire hackathon has almost only two restrictions. First, the team must own at least 10% of the token supply, and priority will be given to teams owning 20% - 50% of the supply. Second, the team must build "publicly," actively sharing their latest progress with the community, and priority will be given to teams that stream live on pump.fun at least 5 times a week.

For the最终 winning tokens, pump.fun will purchase $250,000 worth of tokens at a valuation of $10 million and provide ongoing consulting and incubation support.

This is hard not to remind people of last August, when pump.fun was challenged by the aggressive bonk.fun, they launched GFF (Glass Full Foundation), spending about $1.7 million to buy some well-performing meme coins in their ecosystem.

This hackathon, pump.fun is essentially still "buying coins," but in a more transparent and rule-based way, and the themes are no longer limited to pure meme coins. Based on the above interpretation of the rules, we can speculate on pump.fun's purpose and their understanding of the current market:

- Want to create 12 targets with at least a $10 million market cap

- Without good "control," there won't be new "golden dogs." If it's good control, it's called supply control adapted for long-term development. If it's bad control, it's called bundling.

- Still want to promote their own live streaming feature

- The theme of pure meme coins is too narrow; more narratives are needed for more revenue

At the same time, they have learned from the previous GFF lesson. GFF's promotion was just an announcement, with only a vague goal of "giving back to the ecosystem," and the theme was also limited to pure meme coins. Looking back now, it very much resembles a "wartime product" hastily created to deal with the bonk.fun challenge and the negative public opinion environment.

If following GFF's investments, the coin with the highest return was $neet, which rose over 200% at its peak two months after GFF's purchase, but more GFF holdings spiked instantly and then fell back.

Will this time be different? We cannot predict the future, only learn from history. A cautious strategy might be:

- Focus more on new coins, as new coins can bring more revenue to pump.fun

- Focus more on themes beyond pure meme coins, such as AI, Vibe Coding, or pump.fun live streaming coins

- Focus more on team background and influence, as this is a competition judged by market performance. If the founder is initially unknown, it's not easy to launch in the current market environment.

- Don't be too ambitious and long-term; don't expect pump.fun to do the work of helping those in need.

All of the above tells us that it is not easy to directly bet on "who will be the winner." If a token performs very strongly in the market, it actually doesn't need the official recognition from pump.fun to break through a $10 million market cap. Conversely, if a token needs official recognition from pump.fun as a driving force for its rise, then the token itself might not be that excellent.

Here, we can only look at some projects worth observing based on some available information and personal opinions that do not constitute investment advice.

3 "Case Studies" from the Official

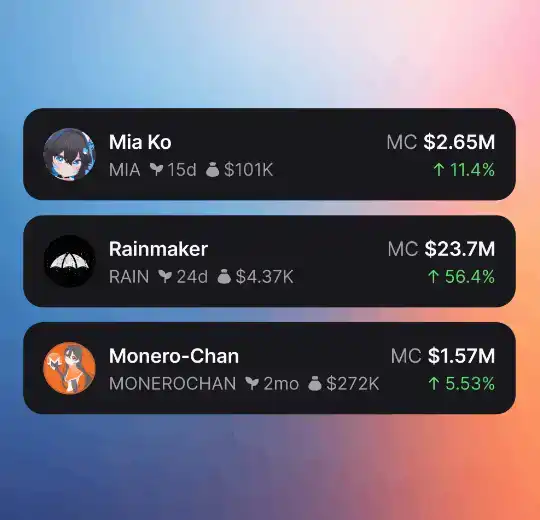

First are the 3 coins that appeared as "case studies" in the official hackathon announcement: $MIA, $RAIN, and $MONEROCHAN.

$MIA is building an interactive, multi-platform AI companion with real emotions. $RAIN is building an AI automated prediction market betting platform. $MONEROCHAN is building privacy DeFi on Solana.

$RAIN has a market cap of about $17 million, while $MIA and $MONEROCHAN are both around $1 million. However, none of these 3 tokens have publicly mentioned on their official Twitter whether they have applied to participate in this pump.fun hackathon, and for $MIA and $MONEROCHAN, it is unclear if the teams meet the hackathon's requirement of "the team holding at least 10% of the token supply."

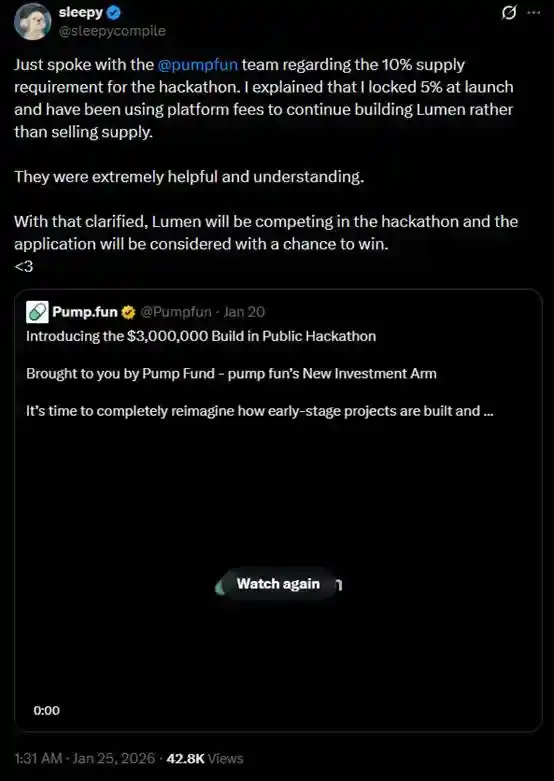

However, according to a tweet from the dev of the $LUMEN token, the requirement of "the team holding at least 10% of the token supply" can be leniently treated with a reasonable explanation.

From the 3 "case studies" given by pump.fun, we can also see that pump.fun might prefer the three sectors of AI, prediction markets, and privacy.

Observations on New Projects That Have Clearly Applied

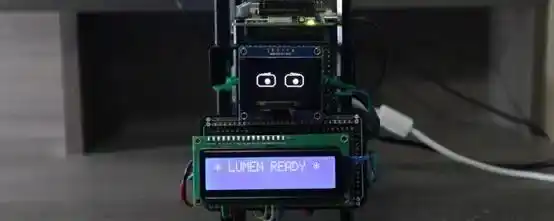

Lumen Frankenstein($LUMEN)

$LUMEN is building a robot that carries a continuously learning and evolving LLM with real emotions. The final product will be delivered to holders, and all delivered products will be connected to a backend cloud server, allowing all robots in the hands of holders to grow synchronously. The current market cap of this token is approximately $1.5 million.

Hyperscape($GOLD)

Under the AI theme, another competitor worth watching is $GOLD. The dev of this token is Shaw, the former founder of elizaOS and ai16z. Although, from TreasureDAO to ai16z, Shaw has issued too many assets and has a poor reputation among players.

$GOLD is the in-game token for the new game Hyperscape being developed by Shaw and his team, where 1 $GOLD = 1 in-game token. As the name suggests, this is a retro-style MMORPG like Runescape, built using AI and incorporating AI Agents powered by elizaOS. The game will be open source.

After briefly surging to nearly a $3 million market cap, $GOLD's current market cap is only about $360,000. Many players mock Shaw, but the final outcome is still hard to say.

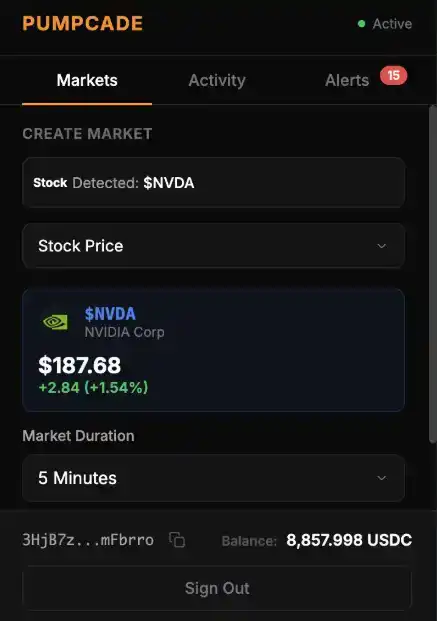

PUMPCADE($PUMPCADE)

In the prediction market theme, a relatively outstanding competitor worth seeing is $PUMPCADE. This prediction market focuses on real-time betting on short-term volatility. Compared to prediction markets more friendly to medium-to-long-term beliefs, Pumpcade targets users seeking short-term entries and exits. For example, users might bet on the odds change for "Will Trump buy Greenland?" in the next hour, or they have developed a data source plugin for Runescape, allowing users to bet on the real-time收益 situation after killing a Boss, and so on.

The current market cap of this token is approximately $3 million, having peaked at nearly $15 million.

The 3 non-"case study" projects mentioned above have clearly stated their participation in the pump.fun hackathon, but this is only for market observation and does not constitute investment advice.